BTC Price Prediction: Navigating Institutional Waves From 2025 to 2040

#BTC

- Technical indicators show short-term bearish pressure but potential reversal signals

- Institutional activity creates both sell-side pressure and long-term demand

- Price predictions must account for accelerating adoption versus cyclical volatility

BTC Price Prediction

BTC Technical Analysis: Short-Term Bearish Signals Emerge

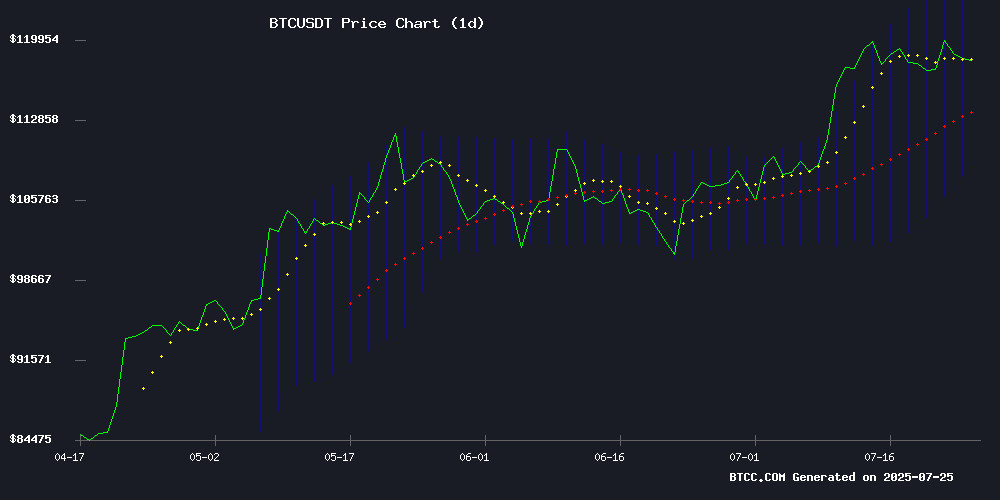

According to BTCC financial analyst Sophia, Bitcoin's current price of $116,163 shows slight bearish divergence against its 20-day MA ($116,335). The MACD histogram at -4,097 suggests weakening momentum, though the narrowing gap between MACD lines hints at potential trend reversal. Prices hovering NEAR the lower Bollinger Band ($109,059) indicate oversold conditions, possibly creating buying opportunities if support holds.

Market Sentiment: Institutional Moves Create Volatility

Sophia notes mixed signals from recent headlines: Galaxy Digital's $1.39B BTC sell-off contrasts with Citi's $199K price target. 'The market is digesting institutional crosscurrents,' she observes, pointing to Robert Kiyosaki's physical BTC advocacy as a counterbalance to ETF skepticism. The $2B preferred equity offering suggests strong institutional appetite despite short-term volatility.

Factors Influencing BTC’s Price

Bitcoin Plummets to $115K Amid Galaxy Digital's $1.39B BTC Sell-Off

Bitcoin's price tumbled to $115,663 in early trading, marking a sharp decline from recent highs. The drop follows a massive transfer of 11,910 BTC ($1.39 billion) by Galaxy Digital from cold storage to exchanges, sparking speculation about its role in the sell-off.

Analysts at Satoshi Club linked the transaction to Bitcoin's 2.5% 24-hour slump, noting the timing coincided with broader market weakness. The movement echoes patterns seen in historic 'ancient BTC' dumps, though Galaxy's motives remain unclear.

Market participants are scrutinizing the implications for institutional BTC holders. Such large-scale disposals often trigger volatility, testing support levels and liquidity across major trading venues.

Bitcoin Hyper Smashes $4.5M in BTC Layer 2 Presale Amid Market Recovery

Bitcoin has shown resilience, bouncing back from Friday's low of $115,000 to reclaim the $116,000 mark. This rebound suggests potential for a broader rally, with $115,000 acting as a critical support level.

Meanwhile, Bitcoin Hyper, a new Bitcoin Layer 2 blockchain, has surged past $4.5 million in its presale. The project aims to enhance Bitcoin's functionality through a ZK rollup solution, offering faster transactions and smart contract capabilities. Its innovative approach combines Solana-like speed with zero-knowledge proofs, targeting sub-second transaction finality—a stark contrast to Bitcoin's typical 60-minute wait times.

Investor enthusiasm reflects confidence in Bitcoin Hyper's potential to unlock new use cases and scale the Bitcoin network. The presale milestone underscores growing demand for Layer 2 solutions as the crypto market evolves.

Bitcoin Price Prediction: Descending Triangle Pattern Signals Potential 100% Move

Bitcoin's price action remains volatile, caught between bullish and bearish forces as it forms a descending triangle pattern. The cryptocurrency faces stiff resistance at the trendline, with critical support holding between $115,000 and $116,000. Market observers note this zone could catalyze a 100% rally if bulls maintain control.

Galaxy Digital has emerged as a significant seller, offloading 12.85K BTC worth $1.5 billion in recent trading. Blockchain data reveals the firm moved 30,000 BTC ($3.5B) to exchanges while withdrawing $1.15B in USDT. Concurrently, dormant whales have awakened, liquidating billions in long-held positions.

The combined selling pressure triggered cascading liquidations, pushing bitcoin below $116K. Technical analysts watch the triangle's resolution closely—a breakout could validate the bullish doubling scenario, while breakdown risks remain.

Citi Forecasts Bitcoin Could Reach $199K by 2025 Amid ETF Demand Surge

Citi's latest digital asset report projects Bitcoin could hit $199,000 by 2025, driven by spot ETF inflows, user adoption, and macroeconomic conditions. The bank's base-case scenario suggests a year-end target of $135,000, revised upward from earlier estimates due to stronger institutional demand.

ETF flows are now structurally reshaping Bitcoin's price behavior, with $15 billion in new inflows potentially adding $63,000 to its valuation. Active wallet metrics and exchange inflows support a baseline price of $75,000, while network effects and adoption growth contribute to the upside.

Risk remains: a bear-case floor of $64,000 is noted if macroeconomic headwinds weaken risk appetite. Wall Street's evolving narrative increasingly treats Bitcoin as part of the broader institutional capital landscape.

Texas Bitcoin Mining Facility Faces Legal Backlash Over Noise and Health Concerns

Residents of Granbury, Texas, are pushing back against a 300-megawatt Bitcoin mining facility operated by Marathon Digital Holdings (MARA). Lawsuits filed in October 2024 allege severe sensory, emotional, and health impacts, including chronic headaches, vertigo, and brain fog. The facility's relentless low-frequency noise has also disrupted local wildlife, with reports of equine anxiety and at least one horse's death linked to the disturbances.

Bitcoin's Proof-of-Work consensus mechanism, while securing the network, demands escalating energy and computing power—a trade-off now manifesting in community strife. The Granbury case underscores growing tensions between crypto infrastructure and residential welfare, even as BTC maintains its dominance in market capitalization and adoption.

Galaxy Digital Market Makers Drive BTC Sell-Off Amid Price Volatility

Galaxy Digital's lead market makers have been actively taking profits, offloading significant amounts of Bitcoin (BTC) on the open market. Their transactions, among the most influential in the past 24 hours, contributed to BTC's decline to a two-week low of $115,000. While long liquidations played a role, spot market activity—particularly from Galaxy Digital—added substantial selling pressure.

The market Maker moved approximately 30,000 BTC to exchange hot wallets, forcing spot markets to absorb up to $3.5 billion in new inflows. Galaxy Digital now holds $1.15 billion in stablecoins, signaling a strategic shift. Meanwhile, Jump Crypto and Wintermute also participated in the sell-side activity, with the latter receiving inflows from Binance.

Despite strong underlying demand from ETFs and corporate treasuries, the directed selling by market makers has introduced short-term volatility, triggering liquidations and price fluctuations in the thousands of dollars. The market's resilience will be tested as it digests these large-scale disposals.

14-Year-Old Bitcoin Whale Moves $1.6 Billion BTC Amid Market Dip

A dormant Bitcoin wallet, suspected to be 14 years old, transferred 14,273 BTC ($1.67 billion) to exchanges via Galaxy Digital, including 5,690 BTC in a single hour. On-chain data reveals over 10,000 BTC were traded on Binance within four hours, coinciding with Bitcoin's recent price decline.

Bitcoin's rally to a record $122,838 on July 14—fueled by institutional ETF inflows and corporate treasury buys—has since cooled, with prices retreating to $115,000. The asset shows mixed performance: down 2.5% daily and 3.2% weekly, but maintains 8.5% monthly and 80% yearly gains.

Market observers now question whether this whale activity signals further correction. The movement underscores how early holders remain pivotal to BTC's liquidity dynamics, even as institutional adoption grows.

Robert Kiyosaki Advocates for Physical Bitcoin Over ETF 'Paper' Investments

Finance author Robert Kiyosaki has issued a stark warning against Bitcoin exchange-traded funds (ETFs), despite their growing popularity among mainstream investors. The 'Rich Dad Poor Dad' creator dismissed ETFs as mere 'paper' assets during a recent social media commentary, drawing parallels between financial instruments and symbolic protection. "Owning a Bitcoin ETF is like carrying a picture of a gun for self-defense," Kiyosaki remarked.

The entrepreneur acknowledged ETFs serve a purpose for novice investors entering crypto markets, but emphasized their inferiority to direct asset ownership. His analysis draws attention to a growing divide in cryptocurrency adoption strategies—between institutional convenience and sovereign asset control.

Market data shows increasing capital flows into spot Bitcoin ETFs, with products from major issuers accumulating billions in assets under management. This trend contrasts sharply with Kiyosaki's philosophy of tangible ownership, creating tension between accessibility and true decentralization principles.

Crypto’s Golden Rule Just Got Broken, According To Analyst

Bitcoin’s traditional four-year cycle has been disrupted, says CryptoQuant CEO Ki Young Ju. Institutional players—through spot ETFs and corporate treasuries—are rewriting the market’s rules. Demand from deep-pocketed buyers now offsets sell-offs that once triggered steep declines.

Earlier this year, treasury companies absorbed twice the Bitcoin that ETFs did. This institutional influx creates a new dynamic: old whales exit, but long-term institutional holders step in. The shift renders traditional retail-driven patterns obsolete.

In March, Ju warned of a downturn as Bitcoin traded NEAR $83,000. On-chain metrics—whale liquidations, MVRV ratios, and bull scores—all signaled bearish momentum. Yet the market defied expectations, underscoring how institutional participation alters price trajectories.

Strategy Expands Bitcoin Acquisition with $2B Preferred Equity Offering

Strategy, formerly MicroStrategy, has escalated its Bitcoin accumulation strategy by increasing its preferred equity offering from $500 million to $2 billion. The MOVE underscores the firm's aggressive positioning as a corporate leader in Bitcoin acquisitions. The Series A Perpetual Stretch (STRC) offering comprises 5 million shares priced at $90 each, featuring a variable dividend rate tied to SOFR to stabilize trading around par value.

Proceeds will directly fund additional Bitcoin purchases, potentially raising Strategy's holdings to 607,770 BTC—worth approximately $72 billion and representing 3% of all mined Bitcoin. The offering follows earlier BTC-backed securities like Stride (STRD) and Strike (STRK), reinforcing institutional confidence in cryptocurrency as a treasury asset.

Michael Saylor's financial engineering continues to draw attention to Bitcoin's role in corporate balance sheets, with Ripple effects across crypto projects like Bitcoin Hyper ($HYPER). Market observers are weighing the implications for broader sector momentum as institutional adoption reaches new thresholds.

Bitcoin Cycle Theory Declared Obsolete as Institutional Players Reshape Market Dynamics

Bitcoin's recent 6% pullback from its $123,000 all-time high has ignited fresh debate about its evolving market structure. CryptoQuant CEO Ki Young Ju now repudiates the traditional 'Bitcoin Cycle' framework that once guided his analysis, acknowledging whales no longer follow predictable accumulation-distribution patterns.

The asset's behavior increasingly mirrors macro instruments rather than speculative crypto assets, with spot ETFs and institutional treasuries now dominating FLOW dynamics. This correction—while historically normal—highlights a maturation phase where sovereign funds and regulated products override retail-driven volatility.

Market observers await confirmation of whether Bitcoin will maintain its correlation with traditional risk assets or rediscover its idiosyncratic volatility. The very definition of 'cycle' may require rethinking as whale wallets cede influence to BlackRock's prospectus and nation-state balance sheets.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Sophia provides this outlook based on current technicals and institutional adoption trends:

| Year | Conservative | Bull Case | Catalysts |

|---|---|---|---|

| 2025 | $140K | $199K | ETF inflows, halving aftermath |

| 2030 | $250K | $500K | Global regulatory clarity |

| 2035 | $800K | $1.2M | CBDC interoperability |

| 2040 | $2M | $5M+ | Network effect dominance |

Note: Predictions assume no black swan events and sustained hash rate growth.